Hello and welcome to post #9! I wrote this post while prepping for my presentation two weeks ago, and then found out I had to prep for a big meeting last week so I didn't get a chance to publish my posts for the last two weeks! I apologize! So by my count I need to catch up on three posts counting this week.

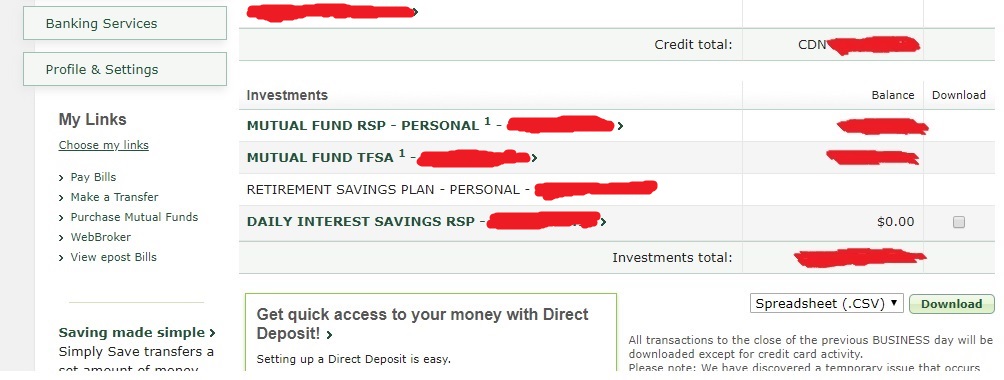

This week I want to go over something I had trouble finding out how to do in my past: balancing your investments. So, say for example you have decided to use my TFSA e-series example in my last post and put your money into the 4 funds divided equally amongst the 4, so 25% each. Now hopefully you have automated your contribution to your investments, again making an equal contribution to each fund. After at least a year has passed, it’s time to rebalance! Rebalancing is important because the amounts in your funds equal your risk tolerance. If, for example, your equities fund is higher than the others then you are assuming more risk as equities are more volatile. If your bonds are higher, then the potential of your investment could be lower as bonds do not normally generate as much interest as an equity. So, if you check the amount in each fund and notice the numbers don’t match their initial levels, it’s time to rebalance them. I’m going to be showing how I do it using TD’s website, as I don’t have to rebalance my other funds. Hopefully your financial provider has a similar system in place.

To start:

- Log into the TD Canada Trust website

- Go to your investments

- Go to your TFSA

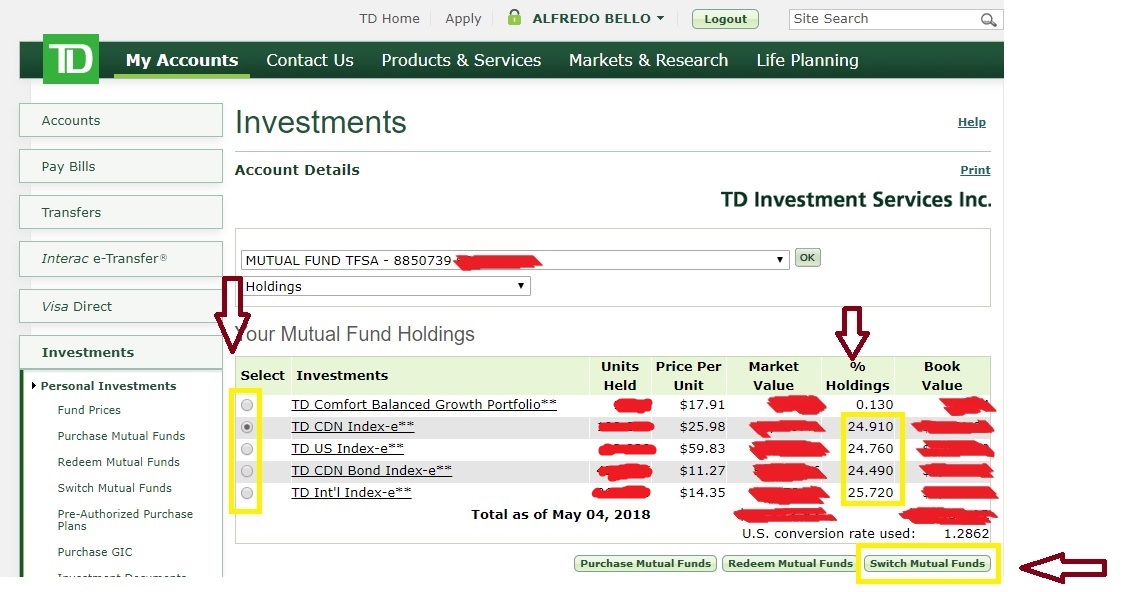

- Observe the balance in the accounts if you see that the percentages are not where you want them to be. This would be the "% Holdings arrow on the

right side". If a fund has a greater value than the others, it's time to rebalance. Start by dividing the total ofnumber by 4 (if we are using the

td-e-series example from my last post) and this is the amount you should have in each account. Next take note of a fund that is less than the others and then

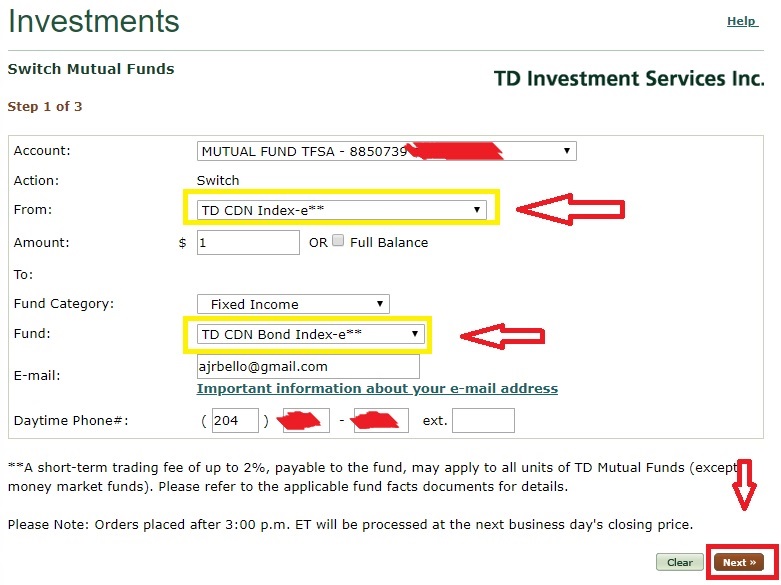

selecting a fund that has a greater value than the others using the radio buttons on the left. Then press the Switch Mutual Funds fund on the bottom right.

- Transfer money from the higher accounts to the lower ones to get their balances even. Make sure that the amount you are taking from the higher

account won't put it less than 25% of the TFSA's totaly value. Note: In TD, if you have a registered account the minimum amount you need to transfer is

$100. Anything less will show an error and won’t let you proceed. Make sure that the "From" and "To" fund fields are correct, the right amount is in

the amount field, and press the Next button on the bottom right

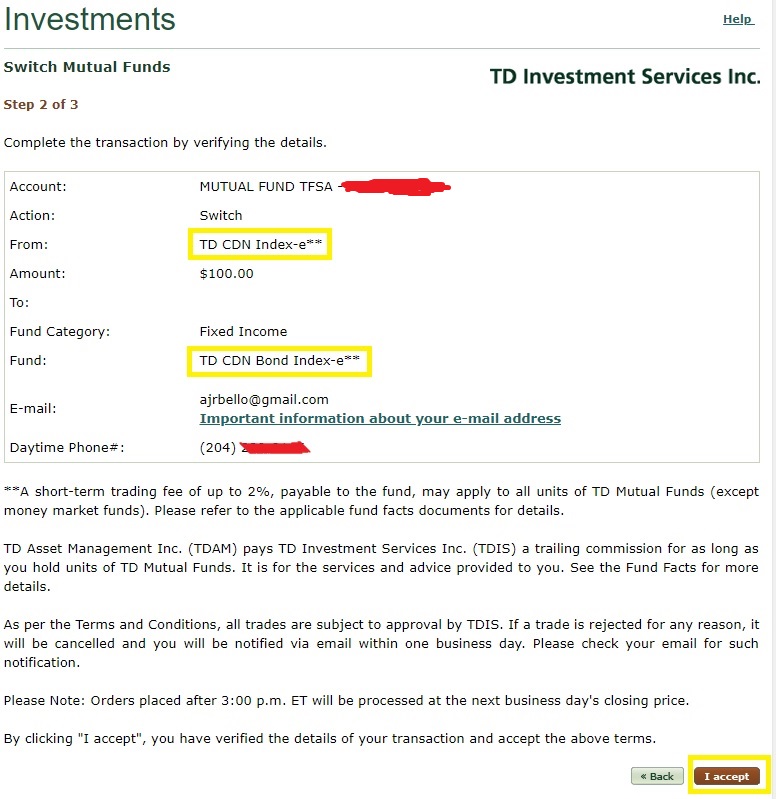

- Confirm the transaction on the next screen by again checking the "From" "To" and "Amount" fields and then press the "I acccept button" on

the bottom right

- The transactions don't go through immedieately, but you should see them get processed within a day

Pretty easy right? Now, make sure you do this every year and watch your nest egg grow! Remember this quote: “I’m not saving for a rainy day, I’m saving to pay my future self”. This is from The Compound Effect by Darren Hardy if you ever have problems justifying saving. You want to be able to enjoy yourself in the future right? I know I do! And the one guaranteed way to do that is through saving.