Hi all, Happy New Years! Today’s post I talk about my experiment deviating from my tried and true investing strategy and the results.

So if you recall from this post,, my investing strategy relies on choosing an index fund and automating my contributions. To quickly recap, you choose an index fund(s), set up an automatic contribution to the account and forget about it till you have to rebalance in a year. That is definitely the tried and true method that holds up over time (20 or so years) and will help you preserve your wealth in the future. Now if you recall from two posts back, I had reached one of my financial goals earlier this year, so I decided to change my strategy for my TFSA a little bit. I had enough saved up that I would still be generating good interest if I converted some of my index funds to cash and invested into other funds. I was hearing alot about weed stocks and how they were going to be the next “big” thing, so 100% buying into the hype I decided to forgo research and try my luck with investing into individual stocks. I’m sure you can guess how well that went!

This is the process I went through to convert my index funds to cash in order to invest in a stock:

- Logged into TD Web Broker

- Decided I would invest up to $10,000 into individual stocks

- Sold $2500 from each of my four index funds. I had almost $25,000 in my index funds at the time so I ended up with $10,000 cash and $15,000 in my TFSA. Note: Selling index funds doesn’t release the cash to your right away. I had to wait about three days before the cash appeared in my account.

- Invested $3500 in Tetra Bio Pharma (stock symbol TBP) and $2000 in Aphria (stock symbol APHA). There’s an option in TD Web Broker to Buy/Sell stocks, so I went to that tab and choose Buy. Note: Since I was putting money into stocks, this transaction cost $10 per stock so it cost me $20 to invest into two stocks.

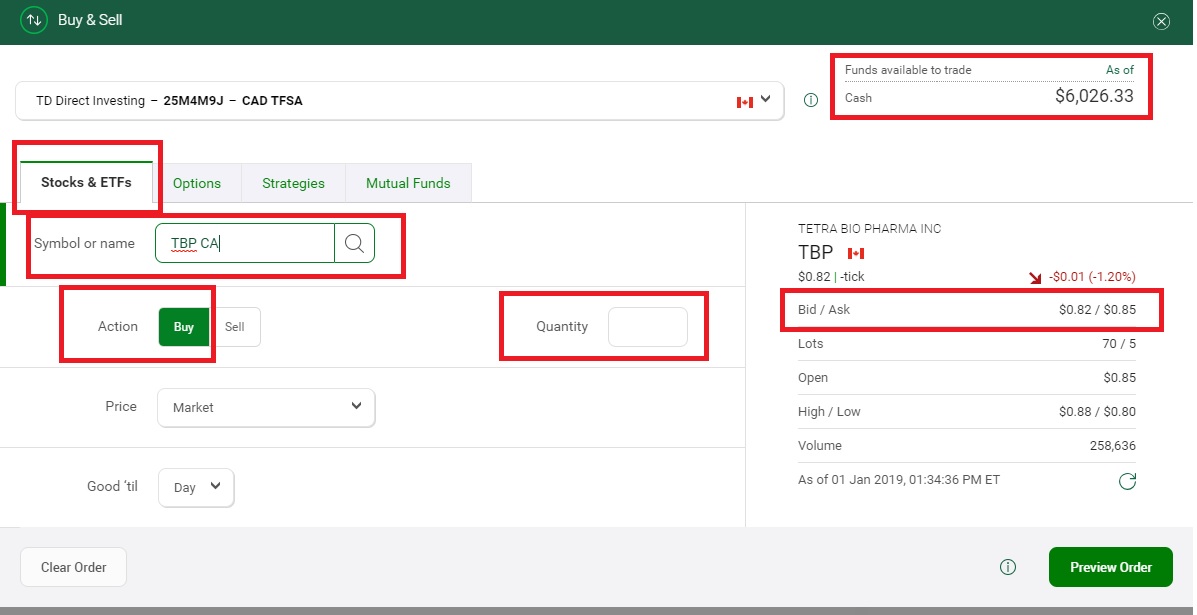

If you take a look at the image above, I’ve hi-lighted a few things you need to be aware of when buying individual stocks:

- Make sure you know how much cash is available in your account because that determines how much of a stock you can buy

- Choose the Stocks & ETF tab to purchase a stock (or ETF)

- Type in the symbol of the stock you wish to buy. You can google the company symbol if you are unsure. You could potentially buy the wrong stock here so make sure you double check it! The nice thing about this field is that it auto completes so if you start typing the symbol it will try to fill out the rest for you. Pretty nifty!

- Make sure you have selected the “Buy” Action

- Quantity is how much of the stock you wish to buy. The price will be the amount you put into this field x (bid/ask amount + $.01). So if we use TBP as an example, if I wanted to buy $100 shares of it I would need 100 X .83 = $83 dollars + $10 commission fee = $93 dollars in my account. You might be wondering why the bid amount is higher than the amount listed on the screen. That’s because of HFT (high frequency trading) technology. Basically, by the time you place your order someone will intercept it, buy the stock at a higher value and then sell it back to you. They’ve only made $.01 cents off each dollar, but think about how many millions/billions worth of stocks are traded daily and they are making $.01 off all of that. It adds up….fast!

Something I need to talk about specifically about investing into individual stocks and ETF’s is that there is a commission fee each time you make a trade (buy/sell) of either one. In my case, it took $20 to purchase one of each stock. You aren’t limited to how much of a stock or ETF you can buy after you pay the commission fee. Well, technically you are limited by how much cash you have available in your account but you know what I mean.

To continue with my story, I invested in those two stocks and they proceeded to drop in value - hard! Within a week I think I had lost a few hundred dollars and I’m at a loss of $500 right now. Not too great for my first run at stock picking! Something to note however in regards to stocks, a loss doesn’t become a real loss until you sell at the lowered value. Until you do it’s just a paper loss. So I’m sitting on my stocks right now, waiting till their value goes up. The projections are that it will go up in the future, but maybe not till later in the year 2019. Of course, there is the opportunity cost of not being able to invest into anything else as that money is being held up in those funds, but since I’m currently a newbie at this sort of thing, I suppose that’s a good thing!

I’ve been doing some research on how to use technical analysis to choose which stock to invest into and I will share that next time. Till then, have a safe and joyful new year and a belated merry Christmas to everyone!